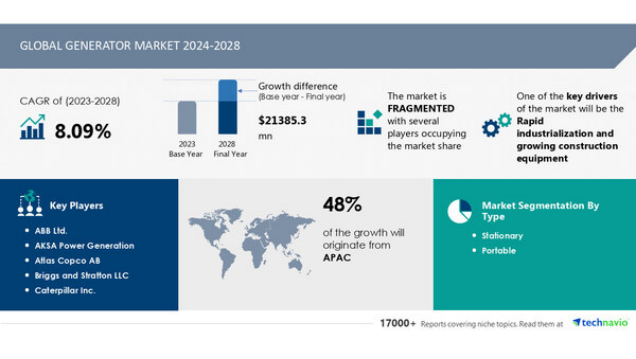

Generator market to grow by USD 21.4 billion from 2024-2028, driven by rapid industrialization and construction equipment

Report on how AI is driving market transformation- The global generator market size is estimated to grow by USD 21.4 billion from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of over 8.09% during the forecast period. Rapid industrialization and growing construction equipment is driving market growth, with a trend towards growing rural electrification programs. However, rising adoption of green energy technologies poses a challenge. Key market players include ABB Ltd., AKSA Power Generation, Atlas Copco AB, Briggs and Stratton LLC, Caterpillar Inc., Cooper Corp., Cummins Inc., Doosan Corp., Eaton Corp. Plc, Generac Holdings Inc., General Electric Co., Honda Motor Co. Ltd., Kirloskar Oil Engines Ltd., Kohler Co., Kubota Corp., Mitsubishi Heavy Industries Ltd., Multiquip Inc., PR INDUSTRIAL Srl, Siemens AG, and Yamaha Motor Co. Ltd..

Market Driver

The global generator market is poised for growth due to the increasing energy demand in various regions. Developed countries like the US, UK, and Japan, as well as emerging economies such as China, and developing regions including Southeast Asia and the Arab States of the GCC, are experiencing power production and consumption gaps. Industrialization in rural areas has further escalated power requirements for industrial purposes, leading to a significant increase in demand for uninterrupted power supplies. These factors are expected to provide substantial opportunities for the generator market during the forecast period.

The Generator Market is experiencing significant trends in various sectors, including agriculture and construction. Agricultural generators are gaining popularity as alternative fuel sources like bi-fuel generators and battery storage systems reduce reliance on diesel. In construction, continuous load requirements for critical infrastructure and communication systems necessitate the use of reliable generators. Developing regions are also embracing generator technology for electrification. Cummins and Generac lead the generator market ecosystem, providing customer service and innovative generator technology. Emission norms and environmental regulations are driving the shift towards hybrid generators and cleaner fuel sources. Factories , hospitals, data centers, and other industries rely on generators for backup power and energy storage. Downtime due to fuel prices and availability can result in substantial financial losses, making generator efficiency and reliability crucial. Electromagnetic induction plays a vital role in generator technology, ensuring electrical energy generation. Emergency response centers and critical infrastructure require immediate power response. Indirect sales channels expand generator market reach, making generator technology accessible to a broader customer base. Overall, the generator market is evolving to meet diverse power needs while addressing environmental concerns and improving efficiency.

Market Challenges

The generation and consumption of power in manufacturing facilities contribute substantially to carbon emissions. Coal-powered electricity, in particular, results in higher carbon output compared to renewable energy sources. With the expansion of businesses through new constructions, the installation of energy-efficient systems with monitoring capabilities is crucial for reducing power consumption and carbon emissions. In the US, manufacturing facilities account for a substantial carbon footprint annually, surpassing many other countries. The increasing awareness of harmful carbon emissions and favorable government initiatives for renewable energy adoption may hinder the growth of the generator market during the forecast period.

In the Generator Market, businesses face various challenges. Noise pollution from traditional power sources like diesel generators can disrupt operations in oil & gas projects and urban areas. In oilfield projects and remote locations, ensuring a reliable power supply for output terminals and production lines is crucial for productivity. Power reliability is a major concern for industries, especially in sectors like pharmaceuticals and telecom, where power outages can lead to significant losses. Power sources and power supply strategies must consider power sources like renewable energy systems, such as solar panels and wind turbines, to mitigate the risks of power outages. Regulations for emissions and noise pollution add complexity to strategy planning for utility companies and third-party service providers. Renewable energy sources and systems are becoming increasingly important for power generation capacity in rural areas and public buildings. Prime movers like rotors and stators in generators require regular maintenance to ensure optimal performance. Transportation and logistics of heavy equipment like generators and renewable energy systems can also pose challenges. In conclusion, businesses in the generator market must address challenges related to power reliability, power sources, regulations, and logistics to ensure productivity and profitability.